Nowadays, almost everyone uses various high-tech devices – bank cards, computers, smartphones, or tablets. The emergence of innovative programs that allow online shopping and various operations from home simplifies everyday life. Despite this, it is important to be cautious and understand that there are many scammers online looking to profit from trusting users. Therefore, it is worth knowing what protective measures exist against scammers.

To avoid falling into the traps of fraudsters, you need to be informed about the schemes they use and how they act towards their victims.

How to Avoid Falling for Scammers' Tricks: Methods of Stealing Citizens' Personal Information

The most well-known method is phishing. This is when criminals send an email to a person with the slogan "urgent." The text may vary, but the point is the same – to make the user instantly provide personal data without thinking. Scammers may pose as employees of a bank or online store. The simple rule here is: do not open suspicious emails that arrive in your inbox.

Smishing is a type of phishing. Only in this case, the fraudulent text is sent via SMS to the phone. Typically, it contains a link to a phishing web resource, encouraging the person to visit this site and enter personal information.

Subsequently, criminals use the stolen data for fraud or to make money. Tip: immediately delete SMS messages received from suspicious individuals.

Vishing – a scam similar to phishing and smishing. However, scammers act through phone calls. Often, "robots" call instead of live people. There may also be notifications sent through voicemail. It is recommended to immediately mark suspicious calls as "spam" or add unknown numbers to the blacklist.

What Security Measures Are Used Against Scammers

Additionally, there are scams related to:

- Bank cards (for example, placing skimmers on ATMs);

- Employment – when the applicant is required to pay a so-called insurance fee for timely job execution;

- Fake QR codes;

- Sending fake tax declarations that need to be filled out, entering not only personal data but also banking details;

- Phone scams (for example, calling with a message that a relative is in trouble);

- Broker scams and investment pyramids.

Therefore, it is very important to know how to avoid fraud. Always use two-factor authentication on government services, tax, and other organizations. Even if a scammer learns the password to your personal account, they won't be able to access it. Always install antivirus software on smartphones, PCs to prevent device infection with viruses and data leaks.

Be cautious about calls from the bank urgently asking for all card details.

Another security measure against scammers is caution when choosing job offers, especially remote ones. Never transfer money as a guarantee of timely task completion.

Fraud Prevention – 5 Main Tips

Avoid viral mailings. They can be sent both to email and phone via SMS. Promises of good bonuses, dubious promotions, and other enticing offers are 100% scams. Never open links and especially do not click on them. Because most likely, the mandatory condition will be the provision of personal confidential information.

A call from the bank's security service when no transactions were made. Sometimes a bank representative calls, mentioning the client's full name, and says that you need to provide the card number, PIN code, and other secret data to cancel a suspicious transaction. Immediately block such calls; these are scammers trying to steal money.

Social media account hacking. This is a very popular case on the Internet. Criminals hack a person's page on Facebook, VKontakte, Instagram, or other social networks. Then they send mass messages to friends requesting to borrow money for a few days. Usually, they ask for a few thousand.

Another protection against scammers is ignoring calls that promise a win: whether it is cash or some product. Without thinking, blacklist numbers that call with such interesting offers:

- They say that the number of the person called was chosen as the lucky one and they won an amount of several hundred thousand (currency may vary). But to receive it, you need to pay a certain percentage;

- They call and inform that the person won a valuable prize and send it by mail. But when the winner comes to receive the goods, it needs to be paid for. Do not do this, as it will only benefit the scammers.

Fraud prevention is an important point. To prevent a social media account or personal account on certain sites from being hacked, create strong, secure passwords and store them in hard-to-reach places.

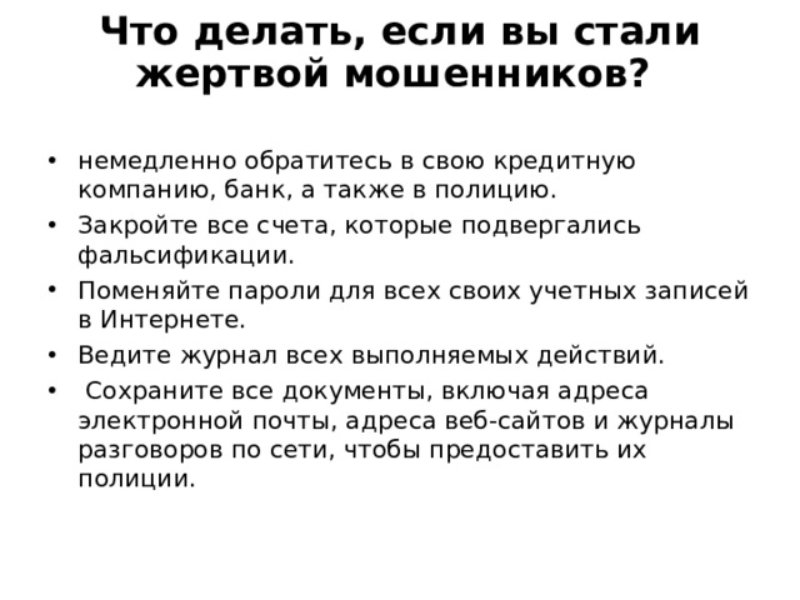

What to Do If You Fall for Scammers' Tricks

It is recommended not to panic immediately. If the scam involves bank cards, you should block it immediately. In case of deception by scam brokers or financial pyramids, the best way is to contact chargeback services. In the event of phone fraud, it is advised to file a report with the police. In any case, it is necessary to gather as much evidence as possible that there was a scam for money.

Knowledge and personal awareness are the best helpers in the matter of protecting yourself from scammers. Remember that scammers are always alert and constantly invent new methods of deception. Therefore, always be attentive in situations involving money. Be vigilant and beware of brazen scammers.