Investment frauds are one of the ways to scam naive users out of money. Their essence lies in getting people to invest money in various assets by all possible means: digital currencies, Initial Public Offering, securities. Meanwhile, crooks promise high returns in the shortest possible time. As a rule, such schemes are developed by criminals who engage in deception professionally.

Every year, scammers deceive investors out of amounts reaching millions. To enable everyone to recognize a fraudulent company, it is necessary not only to know the signs of a “dishonest game” but also to be aware of the types of investment scams.

How investment scams work – the most well-known “traps”

Ponzi schemes – a principle that has been used for many years. The payout of profits is made from the money of other investors who joined the project. The end comes when no new people join the structure.

“Pump and dump” scheme. This phenomenon is most commonly seen in the stock penny and digital currency sectors. Crooks artificially inflate the price of securities or cryptocurrencies, using false statements that “entice” investors to buy into the hype. Once the price reaches a certain level, the fraudsters immediately sell their assets. As a result, investors are left with losses.

Another type of bogus investment scheme is advance fee fraud. Criminals ask their victims to make a payment to gain access to a platform offering to earn on investments. Once investors have paid the advance, the crooks disappear without explanation, leaving clients with empty pockets.

Types of bogus investment schemes

Forex scammers can use various methods to scam users. These include financial pyramids, fake brokerage platforms, and illegal investment projects. The main principle of fraudsters in the Forex market is the promise of attractive earning opportunities with high returns. Usually, these traps catch novices who do not have enough experience trading in financial markets.

Scammers have created a new type of fraud related to investments. Fraudsters offer to invest funds in the sale of “scarce” grain products and promise a return of at least 25%. Swindlers develop a site with positive reviews from investors. Typically, the webpage looks credible. Usually, the deposit is made to the details of a legal entity. Sometimes criminals also suggest taking a loan to earn. When the money in the account runs out or the client applies for a profit withdrawal, the scammers stop communicating with investors. The best outcome that can occur is a complete loss of investments. In the worst case, the client will be left with a credit debt.

Investments in enterprises engaged in the extraction of natural resources. This is another variant of bogus investment schemes. Swindlers develop fake online platforms that are clones of official company websites. They offer to direct investments, for example, into the extraction of precious metals or energy resources. Crooks promise a share of the firm's income, but do not pay it. Also, sometimes criminals recommend investing in securities or non-existent tokens.

<h2> What are the main signs of investment fraud</h2>

It is not always easy to immediately recognize a fraudster company. To protect yourself from investment scam, it is necessary to carefully choose the company for cooperation.

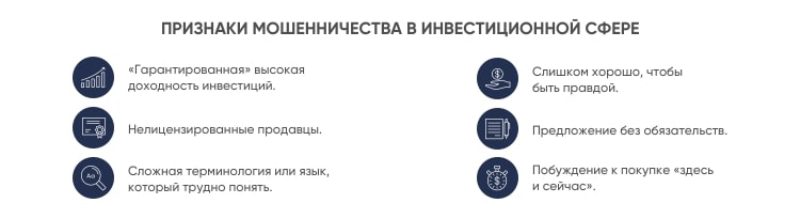

You can spot a scammer by these signs:

- Promises of high profit. If the investment company website has a phrase like: “We guarantee 250% profit in 24 hours”, be cautious;

- Lack of license. A company that does not have a permit to accept investments is dangerous for cooperation;

- A lot of incomprehensible terminology is used on the platform;

- The platform has enticing offers in the format “only here and now”.

Fraudulent organizations – these are primarily investments with a high risk of loss. Never engage with an investment firm whose representatives themselves initiate contact and promise “golden mountains”. Also, be careful when company representatives start applying pressure. For example, they call from the company, talk about their favorable investment terms, and say that you need to deposit immediately, otherwise it will be too late tomorrow. In fact, the person is not given the opportunity to think over the proposal received.

Ways to protect against fraudulent investments

To safeguard your savings from criminals, you don't need to be a professional. One thing is enough here – to approach everything with distrust.

Shield yourself from unsolicited calls and messages offering profitable investment opportunities. Choose licensed companies. Companies operating without a license agreement are 100% unreliable. Always steer clear of offers of risk-free investing. It's important to remember that investing is always a risk.

Aggressive marketing – another tactic in investment fraud. When you come across ads with flashy and straightforward information, know: this is how swindlers attract more clients to the project.

If an investment company offers to invest money to gain high profits in a few days but does not provide precise and specific information, it's a reason to be cautious.

Investment frauds – a negative phenomenon from which there is no 100% protection. Only trust in licensed firms with official registration can help protect money from criminals. Never believe companies that guarantee incredibly high profits with minimal investments and zero risks. Always conduct additional monitoring of the investment company you plan to trust with your investments.